What Sun Tzu Wrote: “…to fight and conquer in all your battles is not supreme excellence; supreme excellence consists in breaking the enemy's resistance without fighting.” What This Means to the Modern Financial Professional: Though not the arena of mortal combat, the FP’s world can certainly be quite vicious and vindictive. The Wall Street Psychologist’s Gyroscope helps the individual maintain their moral center, and their ever so important emotional balance. Vanquishing a foe is not ... Continue Reading

Chapter-By-Chapter Guidance – Chapter 2: Waging War

What Sun Tzu Wrote: “Now, when your weapons are dulled, your ardor damped, your strength exhausted and your treasure spent, other chieftains will spring up to take advantage of your extremity. Then no man, however wise, will be able to avert the consequences that must ensue.” What This Means to the Modern Financial Professional: This section deals with the economics of waging war. For the FP, it is essential to always effectively assess the financial and emotional costs of all ... Continue Reading

Chapter-By-Chapter Guidance – Chapter 1: Laying Plans

What Sun Tzu Wrote: “Those who are victorious, calculate many factors before the confrontation. Those who lose battles, calculate but few factors before the challenge. Many calculations lead to victory, little calculation leads to defeat: how much more so with no calculations at all. By paying attention to this point only, I foresee triumph or defeat.” What This Means to the Modern Financial Professional: In Chapter one, Sun Tzu establishes a series of calculations or factors that ... Continue Reading

The Text Itself: “The Art of War”

Composed of 13 chapters, each devoted to a particular aspect of warfare, “The Art of War” is a powerful work of military strategy and tactical execution. Throughout his work, Sun Tzu espouses strategies that are less methodical steps and more decisive, predetermined responses to emerging conditions. Sometimes, with respect to corporate agendas, it can be helpful to ask yourself: “What is the "real’ (manifest) agenda?” And then: “What is the hidden (latent) one?” What’s the company really up ... Continue Reading

War is Hell, Business Ain’t: Applying Sun Tzu’s

“The Art of War”

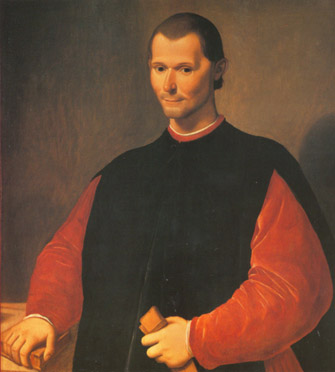

Next to Machiavelli’s “The Prince,” I find that Sun Tzu’s “The Art of War” is probably the most often misinterpreted tome referenced by my patients. A heralded Chinese military genius, strategist, and philosopher, Sun Tzu lived in a very different age than Wall Street of the 21st Century. Though he was supposed to have written his most-famous work in China circa 5th Century B.C., it was not until the 19th and 20th centuries that “The Art of War” gained popularity in the Western world. As ... Continue Reading

The Application of Machiavelli”s Tactics on the Street

The tactics of Machiavelli are more commonly applied today in the world of business than in the present-day world of politics, yet it is not entirely sinister. The financial services industry is a cold, hard world. The business of trading securities, and the myriad of other FP job functions, is not an altruistic venture. It is an ultra-competitive environment and you need an extremely thick skin, a very quick mind, and, at times, a savage heart. Yet, how far do you go in applying Machiavelli, ... Continue Reading

Simon Machiavelli Says

Consider the morality of these quotes from “The Prince” and how they can be leveraged as grounds for misdeeds: “A prince [CEO] never lacks legitimate reasons to break his promise.” “…a prudent ruler [CEO] ought not to keep faith when by so doing it would be against his interest…” “…hatred is gained as much by good works as by evil.” “Of mankind [consumers/clients] we may say in general they are fickle, hypocritical, and greedy of gain.” “…men [competitors] ought either to be well ... Continue Reading

Counseling My Patients vis a vis Machiavelli

As I counsel my patients, it is only through the pursuit of virtue, human dignity, common sense and realism that you can establish the self-esteem and self-acceptance (as opposed to self-loathing) necessary for personal and professional growth and wellness. Only the true narcissist can so baldly justify Machiavellian tactics and not face moral repercussions. Bernard Madoff’s malignant narcissism and psychopathy, as others in the media have attested to, epitomize this observation. In some ... Continue Reading

The Psychology of Machiavelli

The allure of “The Prince” is in its advocacy of cold, calculated objectivity and pragmatism to achieve power. These ancient Best Practices serve as convenient, independent validations to cloak moral responsibility. Yet, even though many corporate raiders may blame Machiavelli for their actions, pragmatically seeking to shed their own culpability, they fail to factor in such inconveniences as guilt, remorse, and other long-term consequences of moral ineptitude and failure. Evaluating “The ... Continue Reading

The Mystery of Machiavelli’s Intentions

Like many seminal works on the subjects of power and success, excerpts of the “The Prince” have been abducted, only to be relentlessly pounded into the molds of hundreds of political and business philosophies, as a sort of a perennial stamp of historical justification. Yet, there is an issue in the selective borrowing of the theories without the consideration of the full context within which they be applied. Surely Machiavelli promoted morally questionable tactics, reinforced with ... Continue Reading

What Would Niccolò Say? -Machiavelli for the Modern FP

What does the term "Machiavellian" mean to you? Deeply embedded within the lexicon of the political and business spheres of Western culture, the term is inexorably synonymous with politically cunning, unscrupulousness, and opportunistic ruthlessness in the insatiable quest and maintenance of power. The term is drawn from “The Prince,” the most popular work authored by Niccolò di Bernardo dei Machiavelli, an Italian political philosopher, writer, and civil servant. “The Prince” theorizes a ... Continue Reading

Updating Aristotle’s “Components of Wealth”

Throughout this blog, I cite research to support the recommendations I make for defining your own personal Gyroscope. Some of this material is from contemporary sources. Yet, for many of the over-arching concepts and themes, I draw from the ancient world. When financial services professionals first enter treatment, we start with a review of some key themes, including virtue, character, greed, obsession, and other classically based time-proven behavioral standards. For these exploratory ... Continue Reading

Money Should Not Be You

In current American culture, it’s alarming to consider the extent to which “the engineers of consent” have succeeded. Individuals may feel they are conscious and in control of what they need, desire, and buy—but are they really? If the media is constantly conditioning us to desire more and more of things we don’t need—which, in effect, makes us believe we need more money than we really do—how can we maintain a sound and rational sense of who we are vis-à-vis our current and prospective monetary ... Continue Reading

Edward Bernays and the Engineering of Consent

In 1947, Sigmund Freud’s nephew Edward Bernays published an essay entitle “The Engineering of Consent.” Bernays defined “the engineering of consent” as the art of manipulating people, specifically Americans, whom Bernays described as “fundamentally irrational” and not to be trusted. Undisciplined, non-intellectual, and amoral people (Bernays claimed) are vulnerable to influences of which they are not even aware and accordingly are highly susceptible to want things they do not actually need. ... Continue Reading

Money is a Complicated Psychological Commodity

For centuries, money has been at the epi-center of human culture. Financial professionals live, think, and breathe money. They buy, sell, invest, insure, protect, hedge, speculate, and create; it’s all about the money. Most (if not all) major brokerage houses have an investment-banking component, and banks are becoming ever more “creative,” particularly on the investment side. Money can bankroll ideas, which are more precious than money, which stimulate trade and inventions (materially and ... Continue Reading

Compensation Levels on Wall Street Continue to Rise

According to the Wall Street Journal[1]: Major U.S. banks and securities firms are on pace to pay their employees about $140 billion this year - a record high that shows compensation is rebounding despite regulatory scrutiny of Wall Street's pay culture. Workers at 23 top investment banks, hedge funds, asset managers and stock and commodities exchanges can expect to earn even more than they did the peak year of 2007, according to an analysis of securities filings for the first half of ... Continue Reading

When Happiness is Never on the Horizon

I have a patient, who recently entered his 60s, and by all outward appearances, he would seem to have reached the pinnacle of his life. But, once you get to know him, you would never know it. He just so happens to be a mental health professional from a working class background. This person sincerely and venomously hates and distrusts most people, including those closest to him. His entire value system is basically an unhealthy, materialistic obsession with money. Unfortunately, he has ... Continue Reading

Value Systems Warp Slowly Over Time

Does accumulation trump genuine achievement? Is accumulation the most important goal/mission of your life. Money and net worth, together with financial health, are critically important life variables. Many FPs either neglect, avoid and/or are unaware of their inner life. Creating blend and balance is the greatest achievement. Having 'enough' money, warm shelter, peace of mind, fulfilling relationships, and passions are truly the 'stuff' of life. A successful career in the financial ... Continue Reading

The Bottomless Line

How do you define yourself? What are your real career objectives? What are your "inner life" objectives. Are you aware of the rich, deep solar system of your mind, your heart, your emotions, and your cognitive resources? Do you love your work? Does your work enhance your sense of self and your core person? Do you honor your intellectual and creative passions? When your career winds down, what will be the ultimate measures of your success? Is there a top to the mountain, ... Continue Reading

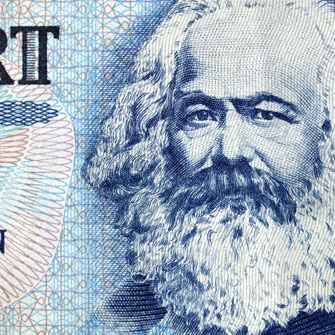

What Would Jesus Adam Smith Do?

Here is an exercise in altered reality. I recommend to financial professionals, in an effort to expand perspectives, to assume the mindsets of Smith, Keynes, and Marx and then execute hypothetical investment scenarios through the mindset of these extraordinary thinkers. Focus on what companies these intellectuals would have invested in, what trends they would be sensitive to, what decisions would they make. This is a fascinating challenge which focuses retail brokers, portfolio managers, and ... Continue Reading

Let Us Not Forget Marx

I have highlighted two giants in the field, Adam Smith and John Maynard Keynes. But there are many different schools of economic theory, and many derivatives of those schools. There are even some capitalists wish never existed, some about as different as Smith as you can imagine. Karl Heinrich Marx (May 5, 1818 – March 14, 1883) was a German philosopher, political economist, historian and political theorist, sociologist, communist, and revolutionary, whose ideas are credited as the ... Continue Reading

Unlocking Keynesian Economics

John Maynard Keynes (June 5, 1883 – April 21, 1946) is another master of economic theory that has relevance for the Wall Street Psychologist’s Gyroscope. More than a half century prior to the “Too-Big-to-Fail” bank bailouts of the US banking industry in the early 21st century, Keynes advocated interventionist economic policy, encouraging governments to leverage fiscal and monetary policies to allay the adverse consequences of downturns in business cycles, economic recessions, and depressions. ... Continue Reading

The Dangerous Illusion of Value

Cycles of greed are based on illusions of value, driven by natural market progressions. In hindsight, it is easy for some to say the events in question should have been anticipated and foreknown, but the fact is that no one was able to halt this juggernaut (LTCM, Lehman, AIG) from nearly destroying our financial markets. Again, we have the Fatal Flaw Theory I previously discussed: “If something seems too good to be true, it probably is.” Why are so many people willing to perpetuate such ... Continue Reading

Adam Smith “Redux:” The Modern Financial Debacle

I wonder how Smith would apply his theories in addressing this latest debacle (from 2008 on). In actuality, there are elements of Smith’s argument that are applicable, especially when it comes to limiting excessive government intrusion into the markets. Again, I do not intend to debate the merits of Smith’s theories, or any other philosopher’s tenets, for that matter. Rather, my point is that every link in the chain that was wrapped around the throat of the global economy during the ... Continue Reading

Mired in the Muck of Credit Default “Swaps”

I wonder what Adam Smith would say regarding Credit Default Swaps? A Credit Default Swap (CDS), on the surface, appears to be a reasonable financial instrument, as it essentially represents insurance on bonds. Think of it like this: an investor purchases bonds issued by Acme Corp., with the expectation to receive periodic payments, every six months. However, there is a likelihood that Acme Corp. may go bankrupt and default on those bonds. This may represent a minimal risk; still, if it ... Continue Reading