Cycles of greed are based on illusions of value, driven by natural market progressions. In hindsight, it is easy for some to say the events in question should have been anticipated and foreknown, but the fact is that no one was able to halt this juggernaut (LTCM, Lehman, AIG) from nearly destroying our financial markets.

Cycles of greed are based on illusions of value, driven by natural market progressions. In hindsight, it is easy for some to say the events in question should have been anticipated and foreknown, but the fact is that no one was able to halt this juggernaut (LTCM, Lehman, AIG) from nearly destroying our financial markets.

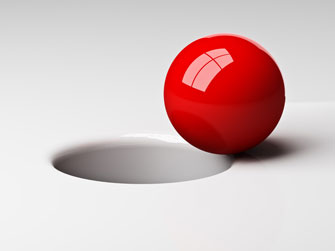

Again, we have the Fatal Flaw Theory I previously discussed: “If something seems too good to be true, it probably is.”

Why are so many people willing to perpetuate such dysfunctional market dynamics?

If history has taught us anything, it is that this is not the last market disaster. In fact, the National Bureau of Economic Research (NBER) estimates that there have been as many as 47 recessions[1] in the United States since the Panic of 1797 (fittingly enough precipitated by a land speculation bubble bursting).

As a financial professional, how do you avoid being sucked down the rabbit hole?

Obviously, dragging Adam Smith into a conversation regarding CDS contracts and banking disasters more than two centuries after his death is absurd. However, it is no more absurd than financial media pundits applying stoic economic theories to explain market machinations, while neglecting to provide equal bearing to psychological influences.

My point is that there are many different schools of economic thought and each revolutionary theorist was right to a significant extent, especially in regard to his particular historical moment and location. As a result we enjoy today a more inclusive model that can be adapted to many different situations as they arise.

Niall Ferguson is correct in his premise that financial history is the de facto history of humanity. Our obsession with the concept of money and its many facets has influenced virtually every major event in our modern evolution.

Ultimately, understanding the Wall Street Psychologist’s Gyroscope requires an appreciation of the psychology of this unbreakable bond, and reconciling that with applicable economic principles. Interpret each master of economics within the context of their argument. If such context is absent, seek it out, and interpret it for yourself within the context of the current situation.

Such is the beauty of human thought and ingenuity.